Micro E-mini S&P 500 Index Futures (Sep 2022) forum

Downside Targets (Bearish Bias Still Intact)

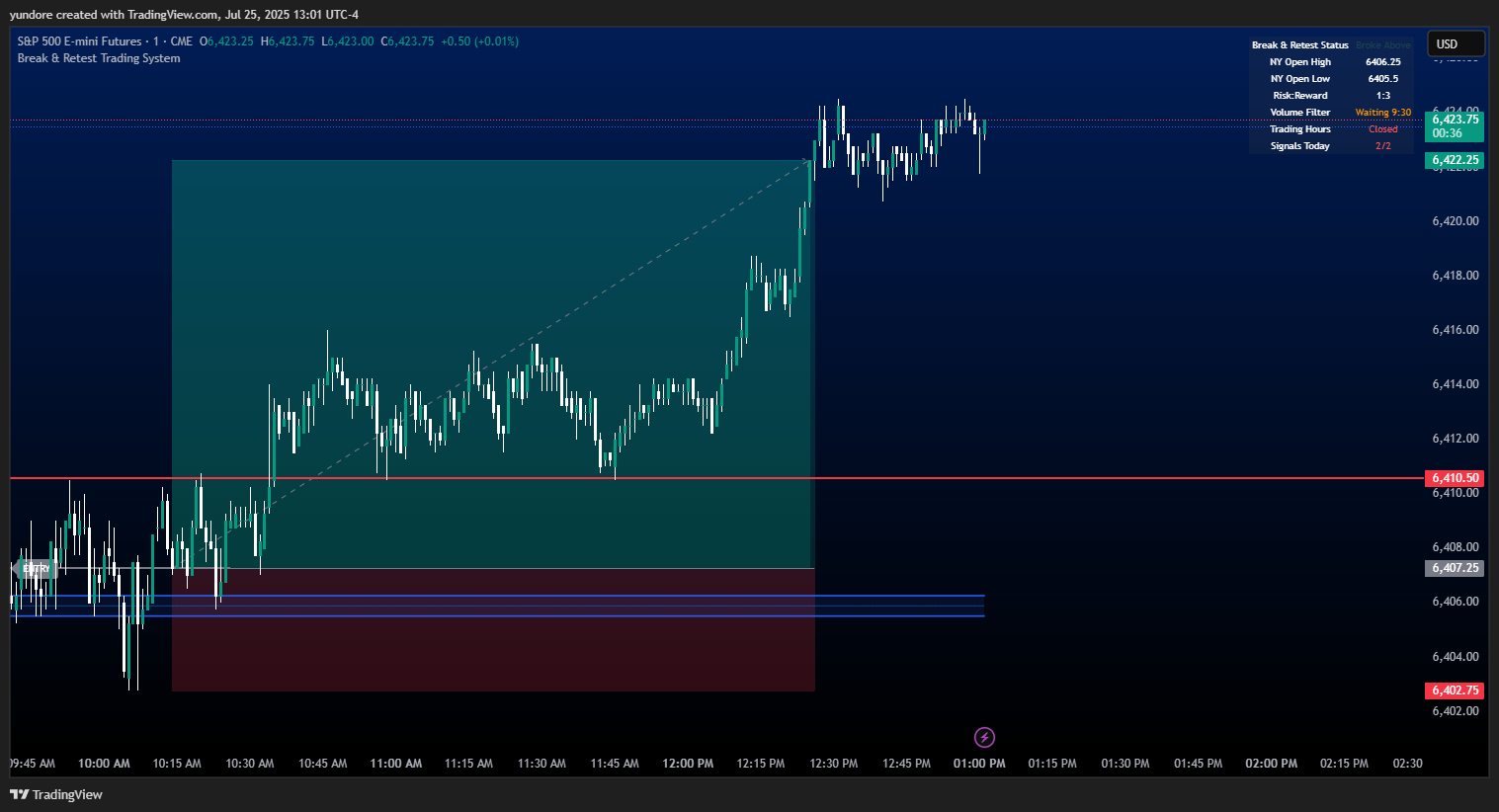

1. Strong Discount Zone:

6,416.00 – 6,410.00

• This is the immediate magnet. Liquidity pool + confluence with Monday low zone.

• Already tapped once but still active.

2. Final Sell-Side Liquidity Pool (if momentum accelerates):

6,405.50 – 6,400.00

• Unfilled inefficiency + full sweep of NYAM low + below key EMA clusters on higher TFs.

• This would complete a full measured move from the NY AM session.

Current ES Price: 6425.00

That 1-min BOS at 9:35 AM confirmed the bearish continuation from 6431.5

Huge red delta candle just printed at

flushing into the Strong Low at 6420.0

Volume spiked — confirmation of aggressive sellers

Price is below VWAP and 9/21 EMA across all LTFs

⸻

Key Observations:

Structure: 5-min shows perfect LH → BOS → LH → LL cascade

Liquidity below remains open down to 6411.25–6408

1-min retests from 6429–6430 were sold into with increasing red volume (good sign)

Outlook for the Day Session:

• If 6420 breaks, waterfall likely opens to 6411.5

• Holding below 6428.75 = bearish bias remains intact

• Only risk? A sharp reversal reclaiming 6432.5–6434, which would violate the LH zone and trigger a CHoCH