Silver Drop??OK, so I see a three point touch forming on the upward trend line on silver. It might break because of the three points, and the downward trend line only has two points meaning that the momentum and that direction is a little bit weaker for breakouts. So I drew a Fibonacci and I'm looking at the retracement which retrace to the golden zone of 61%, and I'm thinking that it's gonna go down to the extension at -61 but could also possibly go down to -27 because it reached the blue line as well that's where it reached in the retracement. Since the touch points are stronger for a bearish breakout that is where my bias is however, silver is overall bullish so I know that it wouldn't last long. But yeah, so with the trendline break, and the Fibonacci tool I'm thinking that price is going to go down on the four hour.

Silver Futures (Jul 2029)

No trades

Market insights

SI (silver) UpdateDoesn't look like silver is done yet, I think it'll head to $100 because that is what everyone expects.

Day traded some SLV calls, closed most of it out on the last pop. Left profits open to see what it does overnight. Probably what I should have done last time. Now it's a no heartburn trade.

Didn't really see much else moving in the market.

SILVER BLOWOFF TOP COMING! $SLV AMEX:SLV – Blow-Off Move Setting Up (Extreme Extension Alert)

Silver is starting to show classic blow-off characteristics, and at this point the risk is no longer on the long side — it’s on the late chasers.

🔹 Why This Is a Blow-Off Setup:

Price is well outside the upper Bollinger Band — a sign of emotional, momentum-driven buying.

AMEX:SLV is more than $10 above the 9 EMA, an extreme stretch by any historical metric.

Momentum has gone vertical, not constructive — this is what end-of-move behavior looks like.

These conditions don’t mean it collapses instantly — they usually mean volatility spikes and risk shifts hard to the downside.

🔹 How I’m Approaching This (Very Important):

I will NOT short weakness.

If AMEX:SLV fades overnight or opens flat/red, I’ll stay away.

What I want to see is a gap up — ideally a large one — that uses up most of its intraday ATR early.

That’s when blow-off reversals tend to trigger.

🔹 Execution Plan:

1️⃣ Trigger: Gap-up exhaustion move at the open.

2️⃣ Confirmation: Failure after ATR expansion / rejection of highs.

3️⃣ Vehicle: Puts, not stock — defined risk only.

4️⃣ Mindset: This is a fade of excess, not a long-term thesis.

🔹 Big Picture:

Blow-offs don’t end with a whisper — they end with euphoria and poor risk/reward.

Silver has gone from trend to mania, and that’s when traders need to flip from chasing to waiting patiently.

Silver is Probably Over... For NowI have been watching the most interesting price action of the end of 2025: COMEX:SI1! (Silver). On the swing timeframes price is completing a fractal of the price action from December 28th:

-Big Selloff

-Attempted Retest of High

-HOLD of the 50% Retracement

-FAILURE to retest/break the high

This type of price action seriously dents momentum especially in such a volatile Rise In Price (RIP).

Fractal Price Action

What is interesting is that this is a fractal continuation of the price action from the Weekly open on Sunday night. The same pattern:

-Big Selloff

-Attempted Retest of High

-HOLD of the 50% Retracement

-FAILURE to retest/break the high

I noted saw this Sunday and wanted to put out a short but options markets were not open and I did not feel like putting down $10,000+ margin risk on Silver. I just noted it to group chats where I have a good friends who are Silver bugs that have been diligently HODLing for over a decade as a warning. I hope they took heed.

The Bubble

At this point in the standard bubble model complacency has been given over to anxiety. This is still a very short term, swing timeframe, pattern at the moment however.

In the long term the most probably pattern will be a full pullback on the Daily. Support may be found at multiple points along the RIP including the 50% Retracement of the recent yeet (65), the Volume Profile node (58), or the Breakout Pivot (53). Then as we get into Q1 2026 we will see the wider move playout. It may not be "over" entirely but definitely for 2025!

Happy New Year!

Silver Bells, Silver Bells, Silver all the way...Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Dashing through the snow

"In a One Horse" open sleigh

Over the hills we go

Laughing all the way

Bells on Bobtails ring

Making spirits bright

What fun it is to ride and sing

A Silver song tonight...

Happy Silver New Year!

SilverF) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of Silver Futures (SI) – 1H chart using SMC + Fibonacci OTE + EMA trend continuation.

⸻

Market Context

• Bias: Bullish continuation

• Strong impulsive rally → clear break in structure (BOS)

• Price is holding above EMA 50 & EMA 200

• Current price action = consolidation / pullback, not distribution

⸻

Why Price Is Pulling Back

• After the impulse, price is pausing near short-term equilibrium

• This is a rebalancing move before continuation

• Pullback is occurring inside discount, which favors longs

⸻

Key Buy Zone (Blue Area)

~71.80 – 72.30

This zone is high-probability due to:

• SMC demand / order block

• Fib OTE zone (0.705 – 0.79)

• EMA 50 support (≈72.03)

• Prior impulsive origin (base of the move)

This is where smart money typically reloads longs.

⸻

Fibonacci Logic

Measured from the most recent impulse low → high:

• 0.5 / 0.62 = shallow pullback

• 0.705 – 0.79 = optimal trade entry (OTE)

Ideal for trend continuation setups

⸻

Trade Idea (Continuation Long)

Buy on confirmation inside demand

• Entry: 71.90 – 72.30

• Stop Loss: Below demand (~71.30)

• Targets:

• TP1: 74.00 (range high / structure)

• TP2: 77.65 (first marked target point)

• Final TP: 80.05 (upper liquidity / extension target)

Risk–Reward: ~1:3 to 1:5

⸻

Confirmation Triggers (Important)

Wait for at least one:

• Bullish engulfing or strong rejection wick from the zone

• Lower-timeframe CHoCH

• Failure to accept below the OTE zone

• Momentum expansion after tapping demand

⸻

Invalidation

• 1H close below ~71.30

• Acceptance below EMA 50 + demand zone

If this happens → bullish idea is invalid, and price may rotate deeper.

⸻ Mr SMC Trading point

Summary

This is a textbook bullish continuation setup:

• Strong impulse

• OTE + demand + EMA confluence

• Clear upside liquidity targets

Please support boost this analysis

Silver Futures (COMEX) – Bullish Structure with Pullback & UpsidSilver Futures on the 1H timeframe are maintaining a strong bullish market structure. Price has respected the ascending trendline and reacted well from the support zone, forming a rounded accumulation before the impulsive upside move. After hitting the resistance zone, the market showed a healthy pullback and created a BOS (Break of Structure), confirming buyers are still in control.

Currently, price is consolidating above the last low, which acts as a key demand area. As long as this level holds, the bias remains bullish. Short-term volatility and minor pullbacks are expected, but the overall structure favors a continuation towards higher highs and a potential breakout above resistance.

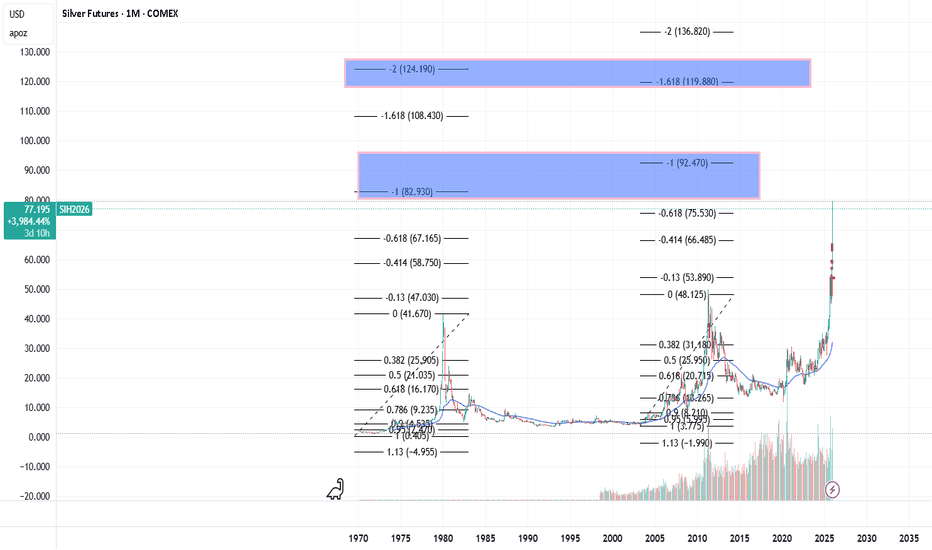

Silver - Next StopSilver has moved sharply higher, and the explosive upward trend is still ongoing.

The move from March to August 2020 can be considered wave 1 and the start of this bullish phase.

The question now is: where will we stop and potentially reverse? In other words, where might the next corrective phase begin.

Fibonacci levels drawn from the first wave and from the last significant corrective wave point to several key areas:

77 - the nearest level, which we have already passed without stopping

89 - the next most probable target

96 - applicable only to the current wave

Time will tell where the next stop occurs.

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

---

Silver Global Cup and Handle Pattern targets $653Fiwithb the rst significant trend line was breached soon after silver broke the 14-year record of $49.28.

The second significant trend line was breached today. A trend line was drawn from each declining peak from the 1980 high through the 2011 high and extended to the present. It is incredible that the last trend line seems headed to a rendezvous with the $653 target for the Global Cup and Handle.

The 2025-2026 Silver Rally + 3-Step Rocket Booster Strategy--

Let me tell you

the amount of research i did

just to be able to confidently write

this message to you has been insane and hard.

And i went down a rabbit hole.

I couldn't stop but i had to come out

for fresh air.

This is what i have found... during

this data of research this is

the most fear i have ever felt.

Let me tell you why...

When i began trading around

2017 silver was one of the first

assets i bought on

margin.

I did this during February

around 2018

i lost all my money on this trade

i remember i kept buying silver COMEX:SI1!

and the price kept crashing..

today the margin level for silver

is high!!

At that time i could only

buy like "x2" margin.

At that time this was considered

very volatile

and expensive.

It was so expensive that

you could lose

your money in one bad trade

Today the margin level is super high around

"20x " minimum bro

the amount of fear from the past

has stuck with me

because at the time

i risked all i had it wasn't much

but i had to go all in to

learn how to trade well.

This was a dark peroid of my life

and now full circle

i cant believe it

am back here again

but this time

am truly humbled

and my fear now is way more higher..

if this trade doesn't go well

am done...

am hanging my gloves with this trading stuff

and going to work a job

at a fast food business

atleast i can eat the food for free

in the back.

Even if am mopping floors and taking out

trash.

But now am going to put in something

special the rocket booster

strategy it has 3 steps:

-The price has to be above the 50 EMA

-The price has to be above the 200 EMA

-The price should increase in momentum or gap up

this last step is measured

by the RSI+Stochastic indicator.

This has been one of the most

challenging articles

because it reminds me

to be humble

and sharing it with you is not easy

so am wishing you happy holidays

because sharing this with you is my gift

and am saying thank you for

following me

and trusting me to help you

on your trading

the rocket booster

strategy is the reason

why i have reached this far on

my trading journey...

In other news the oil and gas

companies seem to be trending

up for example companies like NASDAQ:FANG

follow the rocket booster

strategy and looks like a good buying investment

Long term

If you want you can learn more

about oil and gas companies.

Because i believe this is another trend

going on in the back ground.

Rocket boost this content to learn more

thank you for reading.

Happy Holidays and enjoy!

Disclaimer: Trading is risky please learn about

risk management and

profit taking strategies

Also feel free to use a simulation trading account

before you trade with real money.

SI (silver) UpdateSI MFI went oversold Thu night so I bought some calls Friday, flipped them on open today. I think it will melt up until MFI goes overbought, but I didn't re-enter because I don't expect a big pop up overnight.

SLV calls are expensive, but silver can pop up big, so if you time it right there is definitely money to be made. My return was over 100% with Friday's calls (one week of premium).

Timing is key, not playing the melt up. I finally figured out how to post on my phone, so maybe next time I'll post the trade when I enter.

Chandi Hi Chandi!Chandi is trying to reach till Chand!

Today Silver Future has touched 214583 which is Life time high as of now....

Today after giving a new LTH it is showing the sign of Distribution here.

If Silver Breaks down todays low which is 209000 which is a Support in 1 Hr time Frame it can turn Bearish as also we can see Divergence of RSI is Daily Time Frame.

Once Silver Turns Bearish we can see the level of 180000 in next few weeks.

level of 180000 will be very crucial as if it breaks this level also next stop will be 140000

and if it takes Support from 180000 and shows Bullish Sign here one can invest small qty here well 140000 will be a very good level to invest in Silver.

Lets see!

SI | Week 1 | 1hr chartT.A explained -

BackSide (BS)

FrontSide (FS)

Inverse BS (Inv.BS)

Inverse FS (Inv.FS)

BS & FS levels are expected support when dashed lines, tested when dotted and resistance when solid lines.

The inverse is true for the Inv. BS Inv. FS levels, they are resistance as dashed lines, tested as dotted and support as solid lines.

Monthly timeframe is color pink

weekly grey

daily is red

4hr is orange

1hr is yellow

15min is blue

5min is green if they are shown.

strength favors the higher timeframe.

2x dotted levels are origin levels where trends have or will originate. When trends break, price will target the origin of the trend. its math, when the trend breaks, the vertex breaks too so the higher timeframe level/trend that breaks, the more volatility there could be as strength in the orders flow in to fuel the move.

SILVER (XAGUSD): Multi-Decade ATH Breakout Confirmed. $80+ Next?

The Thesis: After decades of forming a colossal base, Silver (XAGUSD) has confirmed a structural breakout above its multi-decade all-time high resistance zone, previously capped between $49.76 and $55.00. This is not a short-term trade; it marks the beginning of a new secular bull market for the metal.

Technical Confirmation

The Breakout: A sustained weekly/monthly close above the $55.00 level is critical and confirms the elimination of the 45-year resistance ceiling.

Measured Move Target: The completion of this massive basing pattern projects a minimum initial target toward the $75.00 - $80.00 range.

Momentum: Key momentum show strong upward conviction, indicating that this move is supported by heavy institutional volume.

Fundamental Drivers

Structural Deficit: Global mine supply and recycling are chronically insufficient to meet demand. The Solar/Photovoltaic and Electric Vehicle (EV) industries are creating a massive, unyielding demand floor. Analysts project a fifth consecutive year of significant supply deficit.

Monetary Tailwinds: Expectations of a dovish Fed and eventual rate cuts are pushing investors toward non-yielding assets. The Gold/Silver Ratio is falling, suggesting silver is playing catch-up to gold with amplified gains.

Risk Management

The current bullish thesis would be heavily invalidated if XAG/USD sees a decisive weekly close back below the psychological $50.00 level, which was the prior critical resistance turned support.

Silver.. Enough Momentum Left for Upward MoveSilver has given good returns over the past One year. over and above 100%+. Is there any fuel left for upward move and chances of reaching 100$.

Further analyzing on Monthly Chart, momentum is very bullish. Though short term correction is expected (my personal view), overall momentum is bullish.

Looking at the consolidation of Few Fibonacci ratios, and based on previous experiences, expecting silver futures to reach one of the above levels highlighted and rally beyond.

This is completely my personal point of view.