GBPUSD double top: will technical and fundamental drivers align?GBPUSD is setting up for a massive move with a double top forming on the weekly chart. Learn how to catch the breakout and target over 1,300 pips with smart risk-to-reward.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Community ideas

Looking to sell CLI'm looking to sell CL futures based on yesterdays' price action on daily chart which suggests that we might see the next leg down in line with Daily downtrend.

Looking to short pending one more move higher to take equal highs created in early London session and looking for breaker lower to structure logic stop loss and sufficient R:R.

Trading Silver’s Retrace: 50% Equilibrium Strategy for XAGUSD🪙 XAUUSD Technical Analysis

The daily chart for XAGUSD shows a significant sell-off after a strong bullish move, with a retracement of approximately 21.93% from the recent swing high. However, the price has since broken structure to the upside, indicating a potential shift in momentum back to the bulls. The current price action is trending upward, approaching the previous high, which could act as a resistance level. Your plan to look for a retrace into the 50% equilibrium of the recent swing on the 4-hour chart is technically sound, as this level often acts as a magnet for price and a potential area for institutional order flow. Waiting for a pullback and a bullish structural break in your area of interest increases the probability of a successful long entry.

🔍 Key Levels & Price Action

The 50% equilibrium of the recent swing (measured from the swing low to the swing high) is a classic area for price to retrace before resuming the trend. If price pulls back into this zone and forms a bullish structure (such as a higher low or a bullish engulfing candle), it could provide a high-probability long setup. Watch for confirmation on lower timeframes (like the 4H) for added confluence. The previous high around $35 may act as resistance, so partial profits or tighter stops near this level could be prudent.

🌐 Fundamentals & Sentiment

Silver is currently benefiting from a mix of macroeconomic factors. Ongoing inflation concerns, central bank buying, and geopolitical tensions (such as those in Eastern Europe and the Middle East) are supporting precious metals. Additionally, industrial demand for silver remains robust, especially with the global push toward green energy and solar panel production. However, a stronger US dollar or rising bond yields could temporarily cap gains. Sentiment among retail traders is cautiously bullish, with many looking for dips to buy, but there is also a risk of volatility if macro data surprises.

🧠 Alternative Views

Some analysts caution that the recent rally may be overextended, and a deeper correction could occur if risk-off sentiment returns or if the Fed signals more aggressive tightening. Others point to the strong uptrend and suggest that any pullback is likely to be bought, especially if it aligns with key technical levels like the 50% retracement. Keep an eye on COT (Commitment of Traders) data for signs of large speculator positioning, as well as ETF flows for additional clues on institutional sentiment.

📈 Trade Management & Risk

If entering long on a pullback to the 50% equilibrium, consider using a stop loss below the swing low to protect against a deeper correction. Scaling out profits as price approaches the previous high or key resistance zones can help lock in gains. Always use proper risk management and avoid overleveraging, especially in a volatile market like silver.

🎬 Video Title Options

"Silver’s Next Move: 50% Retrace Entry? XAGUSD Trade Idea & Analysis"

"Bullish Breakout or Bearish Trap? XAGUSD 4H Trade Setup Explained"

"Silver Price Action: Waiting for the Perfect Pullback! (XAGUSD Analysis)"

"XAGUSD: Is the Silver Rally Just Getting Started? Key Levels to Watch"

"Trading Silver’s Retrace: 50% Equilibrium Strategy for XAGUSD"

⚠️ Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice. Trading involves risk, and you should always do your own research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

If you are trading JPY, keep an eye on the Tokyo CPIs tomorrowTomorrow, the 25th of April, we are getting the Tokyo CPI figures, which are expected to come out on the higher side. That said, we are looking at the core YoY number, which has a relatively high forecast.

Let's dig in.

FX_IDC:AUDJPY

FX_IDC:USDJPY

FX_IDC:EURJPY

FX_IDC:GBPJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Inverse Head-and-Shoulders FormingI see SPY, QQQ, & SMH forming inverse H&S pattern on the 4 hour chart. The Inverse Head and Shoulders pattern has a higher success rate than the regular Head and Shoulders pattern, with a success/failure ratio of 68.2% compared to 59% for the Head and Shoulders. In 98% of cases, the pattern exits upwards. Additionally, in 74% of cases, the price reaches the pattern's objective once the neckline is broken.

BTCUSD Analysis Today: Technical and On-Chain !In this video, I will share my BTCUSD analysis by providing my complete technical and on-chain insights, so you can watch it to improve your crypto trading skillset. The video is structured in 4 parts, first I will be performing my complete technical analysis, then I will be moving to the on-chain data analysis, then I will be moving to the liquidation maps analysis and lastly, I will be putting together these 3 different types of analysis.

EURUSD FORECASTWhen I look this pair I really love the way that higher timeframe is looking like! Price has already shown the mass psychology and a strong retrace candle which gives a message of a strong reversal to the downside.

In the timeframe of entry I'm looking more of a structure development and insurance play. Let's watch this with a close eye and see what the market is going to give us!

Wishing you a good trading day and God bless!

USDCHF Analysis Today: Technical and Order Flow Analysis !In this video I will be sharing my USDCHF analysis today, by providing my complete technical and order flow analysis, so you can watch it to possibly improve your forex trading skillset. The video is structured in 3 parts, first I will be performing my complete technical analysis, then I will be moving to the COT data analysis, so how the big payers in market are moving their orders, and to do this I will be using my customized proprietary software and then I will be putting together these two different types of analysis.

US500 Day Trade Setup: Liquidity Pools, Gaps & What’s Next?The US500 (S&P 500) 4-hour chart recently showed a gap up, followed by a strong move into the previous range highs. This price action likely triggered buy stops and tapped into buy-side liquidity above the prior swing highs. After this liquidity sweep, the market has pulled back and is now consolidating just above a visible gap, which sits slightly below the current price level.

From a Wyckoff perspective, this resembles an upthrust after distribution, where price runs stops above resistance before reversing. The current pullback suggests a potential test of the gap area, which often acts as a magnet for price, especially if there’s unmitigated liquidity left behind.

Using ICT (Inner Circle Trader) concepts, the recent move above the range high can be seen as a raid on buy-side liquidity, followed by a retracement. The gap below current price represents an imbalance, and ICT traders often look for price to revisit such inefficiencies before resuming the trend.

🌐 Fundamental & Sentiment Backdrop

Recent data shows the S&P 500 has experienced a sharp correction in April, with a monthly drop of about 5.75% from the previous month, but it remains up 6.8% year-over-year (YCharts). The market has been volatile, with sentiment shifting due to macroeconomic concerns, including renewed trade tensions (notably new tariffs), a mixed earnings season, and questions about the Federal Reserve’s next moves (IG).

Wall Street analysts have recently revised their year-end targets lower, citing increased risks from tariffs and slowing earnings growth (Yahoo Finance). The VIX is elevated (28.45), and the put/call ratio is above 1, indicating heightened hedging and caution among market participants (YCharts).

🏦 Wyckoff & ICT Concepts in Play

🏗️ Wyckoff: The recent rally into the highs and subsequent pullback fits the upthrust after distribution narrative. If the market fails to reclaim the highs, a move back into the gap (potentially as a sign of weakness) is likely.

💧 ICT: The gap below current price is a clear area of interest. If price trades down to fill this gap, watch for a reaction—either a bounce (if demand steps in) or a continuation lower if the gap fails to hold.

💡 Day Trade Idea (Not Intra-day)

Scenario: If price trades down to fill the gap just below the current level (around 5,300–5,320), monitor for a bullish reaction (such as a strong daily close, a bullish order block, or a clear rejection wick).

Trade Plan:

🕵️♂️ Wait for price to fill the gap and show a bullish daily signal.

🎯 Enter a day trade long at the next day’s open if confirmation is present (e.g., a bullish daily candle close or a break above the previous day’s high).

🛑 Place a stop loss just below the gap or the most recent swing low.

📈 Target the previous high near 5,400 for a day trade, or consider scaling out if momentum continues.

Alternative: If price fails to hold the gap and closes below it on the daily chart, consider a day trade short the following day, targeting the next liquidity pool below (e.g., 5,200).

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and you should do your own research or consult with a professional before making any trading decisions. Past performance is not indicative of future results.

Is the USD strength back or just a pullback??All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

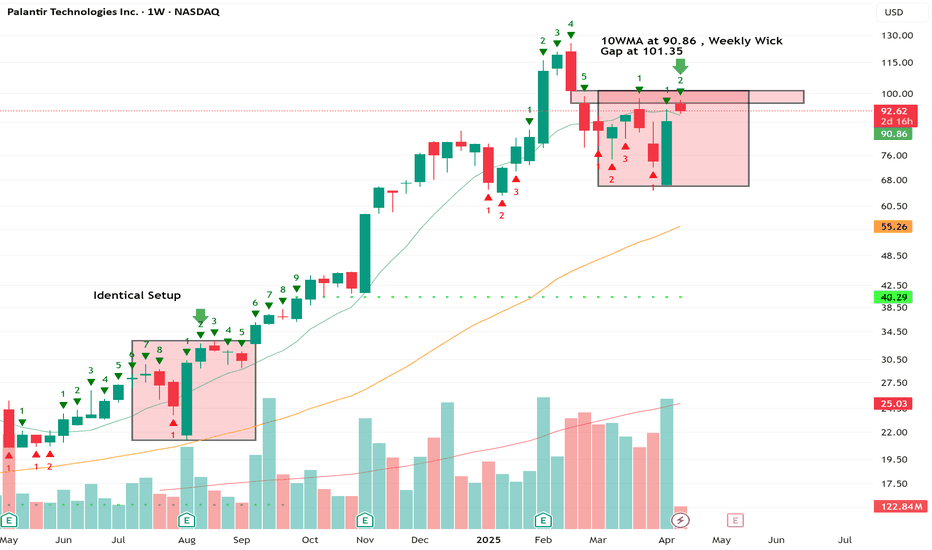

$PLTR Trade: Buy $90.86 , Target $101.35Beep Beep. Hope everyone is taking care of their trading accounts during this volatile phase in the markets. I noticed an identical setup on the weekly from back in August 24' and I'm looking to take advantage. We have a trend reversal on the Tom Demark sequential that helps identify trend exhaustion through a 9 Count. Currently on a 2 Count, we're testing the gap while simultaneously testing the 10WMA at 90.86.There is also a weekly gap at 101.35 ... Entry would be the 10WMA. Target the weekly Gap. Trade is as follows:

Trade Idea - Swing NASDAQ:PLTR $95 Calls 4/25

Entry - 10 WMA @ $90.86

Target - Gap on Weekly at $101.35

EURUSD - Understanding PriceIn this video I go through what has been happening with EURUSD in the past week, where price has reached, where it is likely going, what has happened yesterday and where we are possibly going to go to today. Pretty straight forward stuff using good ol' ICT concepts.

I hope you find this video insightful, because it's the truth of the markets.

Good luck and happy trading!

- R2F Trading

XAUSD 23 DE ABRIL 2025Entry in XAUSUD – Daily Reflection

Today, I exposed myself publicly once again, and I did it for free.

Even though I know that what’s free often goes unappreciated, I chose to give without holding back.

Still, it went really well.

The open entry worked, but the one from the group… that one was marvelous.

Thank you to those who believe and keep showing up.

Rest well—tomorrow, we keep pushing forward.

SPY/QQQ Plan Your Trade Update For 4-23 : Rally-111 PatternToday's pattern really showed up pre-market.

Where was the rally today? It happened before the US markets opened for business.

The SPY/QQQ had already moved up into my upper resistance area on strong buying overnight.

I knew I had to run my father around most of the day, so I booked my profits this morning and tried to catch one little SPY rally (that didn't work out).

So, I started taking some positions for next week's potential downtrend, and I thought, "How much risk am I taking on these trades if the markets continue to move upward?"

I realized I would be taking about $1000 to $1400 in total risk, but my expiration date is near May 16. So my target for any profit really needs to be before May 10th or so.

If the markets do what I expect, I'll be sitting back, watching my profits grow as the markets trend downward into my May 2 Major Bottom (I hope).

I created this video to highlight the now partially confirmed inverted EPP pattern that setup the Ultimate High in early trading today.

Now that we've completed the inverted EPP pattern, we should be looking for the ES/SPY/QQQ to move downward, shift into a sideways/upward price flag. Then, break down into the new Consolidation phase.

Essentially, if my EPP patterns play out well, I timed my move away from longs/calls and into shorts/puts almost perfectly. Now, I just need to sit back and wait for the markets to make a move.

This is what trading is all about. You can't kick the markets to do what you want them to do. You have to learn to take what the markets give you and fall in line with market trends.

When you do that well, profits start to fall into your lap (if you are patient).

Follow along as I break down these market trends and learn how to develop your own skills.

GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

How To Filter Signals On The 1 Minute Scalping IndicatorThis tutorial shows you how to use external indicators to filter out signals on the 1 Minute Scalping Indicator so that you only get signals that are in the direction of the trend.

Step By Step Process:

1. Pick an external indicator that provides an output value of 1 for bullish, -1 for bearish or 0 for neutral and add it to your chart. We have multiple indicators that can do this, but you can also customize your own indicators to provide this value and use that to filter out signals.

2. Set your desired trend parameters on your external indicator and make sure that indicator is on the same chart as the 1 Minute Scalping Indicator.

3. Go to the indicator settings for the 1 Minute Scalping Indicator and turn on one of the 3 available External Indicator Filters. Then from the dropdown menu, select the external indicator you want to use and make sure to choose the output value that gives the 1, -1 or 0 output for trends. Our indicators will have an output titled "Trend Direction To Send To External Indicators" to make that value easy to find in the dropdown menus.

That's it! Let the 1 Minute Scalping Indicator reload with the external indicator trend values and it will only show buy signals during bullish trends, only show sell signals during bearish trends or no signals during neutral markets. Make sure to back test your setup until you find the best external indicators and settings to use that work best for your trading style and then apply that setup to any chart you would like.

Here is the code you can use to add a trend value to your own custom indicators and send it to the 1 Minute Scalping Indicator:

trendDirection = 0

if close > ema1

trendDirection := 1

else if close < ema1

trendDirection := -1

else

trendDirection := 0

plot(trendDirection, title="Trend Direction To Send To External Indicators", color=#00000000, display=display.data_window)

Change the (close > ema1) and (close < ema1) to use your own variables from within your script.

April 23 Trade Journal & Stock Market Analysis April 23 Trade Journal & Stock Market Analysis

EOD accountability report: +2325 on Eval, didn't trade funded

Sleep: 10 hour, Overall health: :check:

— 9:00 AM Market Structure flipped bullish on VX Algo X3!

— 11:30 AM Market Structure flipped bearish on VX Algo X3!

— 12:30 PM VXAlgo ES X1 Buy signal (triple buy signal) B+ set up

— 1:33 PM VXAlgo YM X1 Sell Signal (triple sell signal) B+ set up

— 1:55 PM Market Structure flipped bullish on VX Algo X3!

— 2:30 PM Market Structure flipped bearish on VX Algo X3!

— 3:31 PM VXAlgo ES X1 Buy signal (double signal)

Next day plan--> Short 48m MOB

Video Recap -->

BUYING MOVEMENT IS TAKING PLACE ON USDCADIn this video I will be sharing my USDCAD analysis today, by providing my complete technical analysis by using candlesticks in order to have confidence over the market/control over your emotion no matter what the fundamentals are saying concerning the market, so you can watch it and improve your forex trading skill.

GBPJPY TRADE UPDATE: Is the Bull Run Still On? | Reading CandlesGBPJPY TRADE UPDATE: Is the Bull Run Still On? | Reading Candles

In our latest video, we’re revisiting the GBPJPY trade setup shared earlier this week. With an entry at 188.813, a protective stop loss at 186.814, and a target at 195.170, this swing trade was built on a solid confluence of structure, price action, and momentum bias.

So far, price has respected the entry zone and is making a slow but steady climb. In the video, we break down what’s happening now, how the market reacted to recent news events, and whether the move still has enough steam to reach our target.

We also touch on:

The importance of letting your trade breathe

How to manage open profits without micromanaging

Why patience is one of your most profitable skills

This isn’t just about GBPJPY—it’s about trading with a plan and letting the probabilities play out.

Have you ever exited a trade too early, only to watch it hit your original target later? Let’s talk about that in the comments.

📺 Watch the full update on and stay locked in.