What’s Your Catalyst?

Lately, many QS members have been DM’ing me asking:

“What do you think of this trade idea?”

“Should I go long here?”

“Do you think this setup looks good?”

And my go-to response is always the same:

“What’s your catalyst?”

Because without a catalyst, you’re not trading — you’re guessing.

---

🎮 Trading Is Not a Video Game

New traders often treat the market like it’s a video game.

As long as they “crack the code” of green arrows and red arrows on the chart, they believe they’ll make infinite money.

But that’s not trading.

That’s fantasy.

The harsh truth? Most of these traders haven’t paid their tuition yet.

Some are still in the honeymoon phase.

But the market always gets paid — in blood, time, or money.

---

💀 Real Trading Is Financial Warfare

Trading is not a game.

It’s war.

Behind every price tick, every candle, every fill — is another trader fighting for their financial life.

It’s a sword-to-sword battle. Just because you see it on your phone doesn’t mean it’s not real.

Real trading is life and death for hedge funds, prop firms, and even retail traders trying to survive.

Yet so many jump in, chasing arrows and patterns like they’re spinning a slot machine.

---

🎲 Why You’re Losing with “Green Arrow, Red Arrow”

No offense to TA — it has value. But let’s be honest:

If you’re blindly betting off green and red signals without context, you’re gambling.

You’re just hoping that one of those arrows lines up with a rare, random outlier move — so your one win is big enough to cover all your prior losses.

That’s not strategy.

That’s survival through luck.

---

🔍 What Real Traders Do Differently

To stand out, you need more than pretty charts.

You need information. Insight. Intent.

You need to answer questions like:

Why is this price movement happening?

How far can it go?

What’s driving this move — and what’s the broader context?

You won’t find those answers in price and volume alone.

---

💡 The 4D Framework of Modern Trading

To get an edge, you need to think in 4 dimensions — beyond what most retail traders see:

Market Data – price, volume, trends

Fundamentals – earnings, balance sheets, growth

Macro Forces – rates, inflation, policy, geopolitics

Catalysts – news, events, industry changes

Options Data – implied vol, skew, positioning

This 4D perspective is how modern trading works — and it’s exactly what AI is built to do better than any one trader.

You’re not going to out-research Goldman Sachs.

You’re not going to manually read every 10-K, earnings call, tweet, and Fed update.

But AI can.

---

🤖 AI Isn’t Perfect — But It’s Better Than Gambling

Is AI trading the ultimate answer?

No.

But it’s the closest thing we have to a scalable edge — because it combines massive information processing with human-level reasoning.

The choice is yours:

Stick with “green arrow, red arrow” and hope for Vegas-style luck

Or embrace AI tools that give you a fighting chance through context and analysis

I’ve made my choice.

And every day, my tools — and my edge — get better.

---

🧠 So Next Time You Trade, Ask Yourself

What’s your catalyst?

If you don’t have one, you don’t have a trade.

You have a lottery ticket.

Community ideas

How Much Risk Are You Really Taking?

I get two common horror stories from new QS members:

“I followed a few QS signals, nailed some wins… then bled it all back.”

“My first couple signals lost, and my account was toast.”

My first question to both groups is always the same:

“How much risk did you assign to that trade?”

❌ Why Most Traders Dodge This Question

Risk management isn’t sexy.

Green arrows and slam‑dunk gains are fun to talk about. Stop‑losses and position sizing? Not so much.

Gambling feels easier than math.

Going “all‑in” gives you the casino rush. Calculating max drawdown does not.

Accountability hurts.

If the trade blows up, there’s no one to blame except the person who sized it.

⚔️ Trading = War (No, It’s Not “Fun”)

Like I said in “What’s Your Catalyst?” — trading is financial warfare.

Show up without armor (risk rules) and you’re the first casualty.

In basketball you need defense before dunks.

In war you need body armor before bullets.

In trading you need risk management before any strategy.

📏 My Simple Rule

Only risk what you’re prepared to watch burn—completely.

If the idea of that money turning to ash makes you queasy, you’re oversized. Period.

🧠 Questions to Ask Before Every Trade

Position size: How many dollars exactly can I lose and still fight tomorrow?

Probability: Is this setup strong enough to justify that risk?

Stop‑loss: Where is my hard exit? No “I’ll see how it feels.”

Reward‑to‑risk: Is the upside worth at least 2–3× the downside?

Confidence check: If I’m not 100 % cool watching this cash burn, why am I risking it?

🚀 Pair Your Edge with Protection

AI and QS signals give you edge — a slightly better chance in a brutal game.

But edge without risk control is like a sniper without body armor: lethal until one bullet hits.

Next time you celebrate a hot streak or curse a quick wipe‑out, pause and ask:

“How much risk did I really assign to this trade, and was it worth it?”

If you can answer honestly and still sleep at night, proceed.

If not, size down, armor up, and protect your capital first.

Strong defense wins championships — and trading accounts. 🛡️💰

The Myth of Win RateOne of the most common questions I get from QS members:

“What’s the win rate of the signal?”

Sounds like a smart question. But it's often coming from the wrong mindset — the same mindset as a student cramming for a test, hoping for one perfect answer key that’ll give them a 90% score and an easy win.

Let me break this down for you:

🧮 The Only Two Numbers That Matter in Trading

There are only two math truths that actually grow your account:

Win Rate – how often you’re right

Win/Loss Ratio – how much you make when right vs. how much you lose when wrong

Everyone obsesses over #1.

Almost no one truly understands or applies #2 — and that’s the real killer.

---

🤔 So What’s the Ideal Setup?

In a perfect world, you’d have:

A high win rate (80–90%)

AND a high win/loss ratio (make $3, lose $1)

But guess what?

This isn’t a perfect world — this is a war.

See my earlier post: "What’s your catalyst?"

---

⚔️ Trading Is Like War (or Sports)

In war, victory is rare and costly.

In sports, scoring takes hard work, timing, and discipline.

In trading:

You win big when the odds are stacked in your favor

You cut losses quickly when you’re on the wrong side

That's the gold standard — but few do it.

Even worse, many do the exact opposite:

Take quick profits to “lock in a win”

Let losers run hoping for a miracle

Then they wonder why their account bleeds over time.

---

🎰 Vegas Was Built on 51% Win Rate

Casinos don’t need to win every game. They just need:

Slightly better than 50% edge

Strict control over risk and payout

That 1–2% edge? It built every billion-dollar casino on the Strip.

Now think again:

Why are you chasing a 90% win rate when even 55% + smart risk control can make you rich?

---

🧠 Profitability > Win Rate

You don’t need to win all the time.

You need to win big enough and lose small enough.

Your goal should be:

3 steps forward, 1 step back.

That’s the realistic rhythm of trading success.

---

✅ So Next Time You Ask About a Signal...

Don’t just ask:

“What’s the win rate?”

Instead ask:

“What’s the reward if I’m right?”

“What’s the damage if I’m wrong?”

“How do I size this trade so my wins outgrow my losses over time?”

This is how real traders think.

Not about perfection — but about probability, edge, and sustainability.

---

💬 TL;DR

Win rate is just one piece.

Your win/loss ratio and risk management matter more.

Profitability > accuracy.

The market doesn’t reward perfection. It rewards preparation, defense, and discipline.

Keep playing smart, not perfect.

And remember — it’s a long game. 🧠📈

How I Manage Risk (When Buying Options) If you’ve read my previous post — “How Much Risk Are You Really Taking?” — you already know my view on risk:

Treat every trade like watching your cash burn in front of you.

Ask yourself:

💭 “Would I be OK watching this much money disappear right now?”

If your answer is yes, take the trade and move on.

If it’s no, don’t do it — resize it.

🚫 What Not to Do:

Many traders fall into the trap of:

“I’ll think about it later”

“I’ll set a mental stop and cut if it hits my level…”

That approach has two fatal flaws:

#### ❗ 1. Execution failure

You might not react fast enough when the market hits your level — or worse, you’ll forget to act at all.

#### ❗ 2. Emotional resistance

Even if your stop level is hit, will you actually cut?

Probably not.

Human nature avoids pain and chases pleasure.

Cutting a loss — even a planned one — is painful. That’s why mental stops often fail.

Mental stops:

Add more burden to monitor

Add more emotion to your decision-making

That’s why I keep it simple.

---

✅ My Risk Rule for Buying Options:

Every dollar of premium I spend is 100% acceptable to lose.

This way:

I don’t need a mental stop.

I don’t need to watch it every second.

I sleep well, regardless of outcome.

---

📊 How Much Do I Risk?

It depends on account size and account type:

#### 📌 Main Account:

Risk 1–2% per trade

Never more than 5% on a single trade

Rarely hold more than 3 trades at once

Targeting 6–10% total exposure, only if trades are uncorrelated

⚠️ SPY & QQQ are NOT uncorrelated — don’t fool yourself.

#### 📌 Small Account:

Can risk 5–10% per trade, but only on A+ setups(See: “What’s Your Catalyst?” for what qualifies as A+ in my book)

The goal of a small account is different: it’s about growth — but still must be strategic.

---

💰 “But How Can I Make Big Money Risking So Little?”

This is the common pushback I get:

“Shouldn’t we take big risks to get big rewards?”

Sure — high risk = high reward.

But high risk also = high chance of blowing up.

Even if you hit a few big winners, you’ve compromised your long-term survival.

That’s not trading. That’s gambling.

---

🧠 What I Actually Look For:

Low Risk / High Reward.

Yes, they’re rare.

Yes, they’re like lotto tickets.

But you don’t need to win often if you only risk a little and win big when it counts.

What’s not rare is:

Traders risking big on uncertain setups

Going all in on gut feelings

Wiping out in one or two bad trades

That’s not strategy — that’s self-destruction.

---

🧾 The 2 Core Rules of Risk:

Protect capital at all costs

Only take trades where potential reward outsizes the risk

Don’t flip the logic.

Too many traders hear “high risk = high reward” and assume high risk is required.

It’s not.

That mindset is built for Vegas, not for Wall Street.

---

🧠 If You Want to Be a Trader — Not a Gambler:

You must believe in:

Small risk, big reward

Patience

Discipline

Letting time and luck compound your edge

No other way.

🎯 If you truly get this… congrats.

You’ve crossed the line from gambling to trading.

How to Do Your “Trading Homework” (The Smart Way)

If you’ve been following this channel, you’ve heard me say it many times:

Trading is war — and you should never enter a battle unprepared.

But here’s the real question:

How exactly do you prepare?

The answer lies in a powerful strategy I use called:

💡 Thematic Investing

Read more here →

Instead of chasing news or signals in isolation, thematic investing means:

You first understand where the world is heading

Then you position yourself ahead of that move

It’s not about reacting. It’s about anticipating.

---

❌ What Most Traders Do Wrong

Most beginners:

Follow one tweet

See one red or green arrow

Watch one chart pattern

Then they jump in blindly.

That’s not trading — that’s guessing.

News headlines and chart moves reflect what already happened.

But your edge comes from understanding what’s likely to happen next.

---

✅ What I Do Instead (with QS AI)

Back in the day, doing thematic analysis manually could take hours of reading across dozens of news sites, earnings calls, and macro reports.

But now?

QS AI does the heavy lifting for you — in seconds.

Here’s how I do my “trading homework” every week using QS signals:

---

🧠 Step 1: Start with the News Theme

Go to 📰news-signal — let the AI scan hundreds of headlines and summarize the key themes shaping the week.

Ask yourself:

What’s the main event or policy shift?

Which sectors are directly impacted?

Who are the winners and losers?

---

🔎 Step 2: Zoom Into Sectors or Stocks

Once you spot a theme, use other QS signals to dig deeper:

⏰0dte for fast-moving trades (same-day catalysts)

📅weekly-options for 1–5 day plays

💸earning-signal for earnings-related positioning

🔄swing-signal for broader trend/position trades

---

📈 Real Examples of Thematic Trades

Let me walk you through a few past trades — all built off this exact process:

✅ BBB Defense Play

Theme: Bill passed removing EV credits, boosting defense

Strategy: Long PLTR / Short EV sector using 📅weekly-options

✅ Robinhood Crypto Tokenization

Theme: Robinhood’s crypto product event

Strategy: Crypto stocks pump → took profits early

✅ Tesla Robotaxi Week

Theme: TSLA reveals AI & robotaxi push

Strategy: Long TSLA / Short UBER

✅ Earnings Play: MSFT vs AAPL

Theme: MSFT cloud beat, AAPL revenue drop

Strategy: Long MSFT / Short AAPL using 💸earning-signal

All these trades started with thematic awareness → followed by precise signal-based execution.

---

⚙️ Your Homework Checklist (The QS Way)

Before every week or trade, ask:

📰 What is the major theme driving markets this week?

🧠 What sectors or companies are most impacted by this theme?

🔀 Can I find a relative strength/weakness pair to trade?

⏳ What’s the best time frame? (0DTE, weekly, swing?)

📊 What do QS signals say about timing, momentum, and volatility?

---

🤖 Why QS AI Gives You the Edge

Doing this manually would take you 5–10 hours a week.

But with QS AI:

You scan the entire news cycle in 10 seconds

Get real-time themes and reactions

Pair it with high-quality trade setups

Prepare your game plan before the market opens

This is how we prepare smarter, not harder.

No more chasing arrows.

No more gambling.

Just clean, thematic, risk-aware, high-conviction trades.

---

🏁 Final Thought

There are no guarantees in trading.

But there is a smarter way to prepare.

Thematic investing + QS AI gives you the best shape to step into the market and fight with confidence.

Follow where the world is going — one theme at a time.

That’s how we trade with QS. That’s how we print. 🧠💥💰

Select Your Trading Time

There’s an old saying:

“Plan your trade, and trade your plan.”

But I want to add something even more important:

“Pick your time to trade.”

---

💰 The Market Is Not Your ATM

Everyone enters trading with one goal: make money.

Some even think of the market as an ATM — pull the handle, cash comes out.

But the truth is:

❌ The market doesn’t care about your goals

❌ It won’t move just because you need to make money today

This is a brutal game. And you don’t control the clock.

---

⚠️ When You Force a Trade...

Too many traders say:

“I have to make money today.”

“I need to hit $X this week.”

“I just took a loss, I must come back now.”

That kind of thinking leads to:

Bad entries

Overtrading

Emotional decisions

Big losses

❗ Trading success doesn’t come from forcing outcomes — it comes from waiting for the right moments.

---

🧠 What Happens on Low-Volatility Days

Let’s take today as an example.

SPY moved in a 2-point range all day.

No momentum, no trend, just chop.

Some traders:

Ran one QS signal after another

Forced trades just to feel busy

Got chopped up by fast reversals

Then blamed the signals

But here’s the truth:

AI or not , you can’t expect any long-volatility trade to work when the market is dead still.

The only winners on days like today? Market makers and options sellers.

---

❓ Why Trade at All on a Day Like This?

If the market isn’t offering opportunity,

Why force it? Why chase trades? Why burn your energy?

The smarter move is:

Sit out

Observe

Wait for better setups

Preserve your mental and financial capital

---

🔄 Recovery? Yes — But on Your Terms

Some traders lose money and say:

“I need to make it back today.”

That’s emotional revenge trading.

What if the market doesn’t give you a clean opportunity today?

Are you still going to go all-in, out of frustration?

❌ That’s not a strategy. That’s gambling.

---

📍 QS Signals Are a Map — Not a Magic Button

QS AI signals help you find opportunities — but even the best map won’t help if:

You're in the wrong city (bad market environment)

You’re rushing without checking road conditions (volatility, news, timing)

Even with QS, you don’t have to trade every day, every hour.

---

✅ What You Should Do

Be patient

Respect market conditions

Take a break on slow or tricky days

Come back when the odds are in your favor

---

🧘♂️ Final Words

You don’t have to win every day.

You don’t have to trade every day.

You don’t even have to be active to be successful.

🎯 Trade less. Trade smarter. Select your time wisely.

That’s how real traders survive and thrive in this game.

How We’ll Trade Earnings This Season Earnings season is almost here — and if you're with QS, you’re already holding the most powerful edge in the market.

Let me walk you through how QS trades earnings, why we built 💸earning-signal, and how you can use it most effectively this quarter.

---

📜 A Little History: The Birth of 💸earning-signal

When QS launched in early April, we started with just two short-term signals:

⏰0dte

📅weekly-options

Both focused on short-term options trades.

Then came TSLA earnings in late April. That’s when we launched our very first 💸earning-signal — and nailed the prediction.

Since then?

We’ve had one of the best earnings win streaks on the internet. Period.

📌 Don’t take my word for it — check:

#✅signal-recap for the track record

#🤑profits and #🤩member-testimonials for real wins from members

---

🤖 Why We Built a Separate Earnings Signal

Earnings are not regular trading days. The dynamics are completely different.

On normal days, a stock might move <1%

On earnings? 10–20% swings are common

This is what we call a “pivot event” — and it requires a different engine to predict.

That’s why we separated:

📅 #weekly-options → normal day-to-day setups

💸 #earning-signal → high-volatility earnings plays

---

🧠 How a Human Would Trade Earnings...

If you wanted to manually trade an earnings report, you’d need to analyze:

Past earnings reactions

Analyst expectations

Earnings call language

Financial statement surprises

Options IV & skew

Post-earnings stock behavior

This would take hours (or days) — and most retail traders don’t have time.

---

⚙️ How QS AI Does It Instead

We built 💸earning-signal to do all that work for you — and more.

✅ It pulls in all the data above

✅ Runs it through 5 top LLM models (each acts as an independent analyst)

✅ Aggregates their insights + calculates probability-weighted direction & strategy

✅ Uses fine-tuning to learn from its past prediction success/failures

This means: faster decisions, deeper insights, and better accuracy — every week.

We don’t just run predictions. We let the AI learn from past mistakes and self-improve each quarter.

---

💥 Results Speak for Themselves

Last season, we nailed:

TSLA

MSFT (10x–20x winners!)

NVDA

AAPL

And many more...

All based on this unique AI-driven earnings analysis stack.

This season?

We’re going harder, faster, and even smarter. 📈

🎯 The goal is clear:

Make 💸earning-signal the #1 earnings prediction system in the world.

---

🧩 Final Notes

Earnings are 10x harder to trade than regular days

But with QS, you’re equipped with 500x the speed and insight of an average trader

Upgrade if you haven’t yet: #💰upgrade-instructions

Earnings season kicks off next week

Let’s get it.

Let’s win big.

Let’s make season 2 of 💸earning-signal our most legendary yet. 🚀💸

Learn the 3 TYPES of MARKET ANALYSIS in Gold Forex Trading

In the today's post, we will discuss 3 types of analysis of a financial market.

🛠1 - Technical Analysis

Technical analysis focuses on p rice action, key levels, technical indicators and technical tools for the assessment of a market sentiment.

Pure technician thoroughly believes that the price chart reflects all the news, all the actions of big and small players. With a proper application of technical strategies, technical analysts make predictions and identify trading opportunities.

In the example above, the trader applies price action patterns, candlestick analysis, key levels and 2 technical indicators to make a prediction that the market will drop to a key horizontal support from a solid horizontal resistance.

📰2 - Fundamental Analysis

Fundamental analysts assess the key factors and related data that drive the value of an asset.

These factors are diverse: it can be geopolitical events, macro and micro economic news, financial statements, etc.

Fundamental traders usually make trading decision and forecasts, relying on fundamental data alone and completely neglecting a chart analysis.

Price action on Gold on a daily time frame could be easily predicted, applying a fundamental analysis.

A bearish trend was driven by FED Interest Rates tightening program,

while a strong bullish rally initiated after escalation of Israeli-Palestinian conflict.

📊🔬 3 - Combination of Technical and Fundamental Analysis

Such traders combine the principles of both Technical and Fundamental approaches.

When they are looking for trading opportunities, they analyze the price chart and make predictions accordingly.

Then, they analyze the current related fundamentals and compare the technical and fundamental biases.

If the outlooks match , one opens a trading position.

In the example above, Gold reached a solid horizontal daily support.

Testing the underlined structure, the price formed a falling wedge pattern and a double bottom, breaking both a horizontal neckline and a resistance of the wedge.

These were 2 significant bullish technical confirmation.

At the same time, the escalation of Israeli-Palestinian conflict left a very bullish fundamental confirmation.

It is an endless debate which method is better.

Each has its own pros and cons.

I strongly believe that one can make money mastering any of those.

Just choose the method that you prefer, study it, practice and one day you will make it.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Sector Rotation Strategy🌐 Sector Rotation Strategy: A Smart Way to Stay Ahead in the Stock Market

What Is Sector Rotation?

Imagine you're playing cricket. Some players shine in certain conditions — like a fast bowler on a bouncy pitch or a spinner on a turning track. The same idea applies to stock market sectors.

Sector Rotation is the process of shifting your money from one sector to another based on the market cycle, economic trends, or changing investor sentiment.

In simple words:

"You’re moving your money where the action is."

First, What Are Sectors?

The stock market is divided into different sectors, like:

Banking/Financials – HDFC Bank, Kotak Bank, SBI

IT– Infosys, TCS, Wipro

FMCG – HUL, Nestle, Dabur

Auto – Maruti, Tata Motors

Pharma – Sun Pharma, Cipla

Capital Goods/Infra – L&T, Siemens

PSU – BEL, BHEL, HAL

Real Estate, Metals, Energy, Telecom, etc.

Each sector behaves differently at various stages of the economy.

Why Is Sector Rotation Important?

Because all sectors don’t perform well all the time.

For example:

In a bull market, sectors like Auto, Capital Goods, and Infra usually lead.

During slowdowns, investors run to safe havens like FMCG and Pharma.

When inflation or crude oil rises, energy stocks tend to do better.

When interest rates drop, banking and real estate might shine.

So, instead of holding poor-performing sectors, smart investors rotate into the hot ones.

How Does Sector Rotation Work?

Let’s say you are an investor or trader.

Step-by-step guide:

Track the economy and markets

Is GDP growing fast? = Economy expanding

Are interest rates high? = Tight liquidity

Is inflation cooling down? = Growth opportunity

Observe sectoral indices

Check Nifty IT, Nifty Bank, Nifty FMCG, Nifty Pharma, etc.

See which are outperforming or lagging.

Watch for news flow

Budget announcements, RBI policy, global cues, crude oil prices, etc.

E.g., Defence orders boost PSU stocks like BEL or HAL.

Move your capital accordingly

If Infra and Capital Goods are breaking out, reduce exposure in IT or FMCG and rotate into Infra-heavy stocks.

Real Example (India, 2024–2025)

Example: Rotation from IT to PSU & Infra

In late 2023, IT stocks underperformed due to global slowdown and US recession fears.

Meanwhile, PSU and Infra stocks rallied big time because:

Government increased capital expenditure.

Defence contracts awarded.

Railway budget saw record allocations.

So, many smart investors rotated out of IT and into:

PSU Stocks: RVNL, BEL, HAL, BHEL

Capital Goods/Infra: L&T, Siemens, ABB

Railway Stocks: IRFC, IRCTC, Titagarh Wagons

This sector rotation gave 30%–100% returns in a few months for many stocks.

Tools You Can Use

Sectoral Charts on TradingView / Chartink / NSE

Use indicators like RSI, MACD, EMA crossover.

Compare sectors using “Relative Strength” vs Nifty.

Economic Calendar

Track RBI policy, inflation data, IIP, GDP, etc.

News Portals

Moneycontrol, Bloomberg, ET Markets, CNBC.

FIIs/DII Activity

Where the big money is going – this matters!

Sector Rotation Heatmaps

Some platforms show weekly/monthly performance of sectors.

📈 Sector Rotation Strategy for Traders

For short-term traders (swing/intraday):

Rotate into sectors showing strength in volumes, price action, breakouts.

Use tools like Open Interest (OI) for sector-based option strategies.

Example:

On expiry weeks, if Bank Nifty is showing strength with rising OI and volume, rotate capital into banking-related trades (Axis, ICICI, SBI).

Sector Rotation for Long-Term Investors

For investors, sector rotation can be used:

To reduce drawdowns.

To book profits and re-enter at better levels.

To ride economic trends.

Example:

If you had exited IT in late 2022 after a rally, and entered PSU stocks in early 2023, your portfolio would’ve seen better growth.

Pros of Sector Rotation

Better returns compared to static investing

Helps avoid underperforming sectors

Takes advantage of macro trends

Works in both bull and bear markets

Cons or Risks

Requires monitoring and active management

Timing the rotation is difficult

Wrong rotation = underperformance

May incur tax if frequent buying/selling (for investors)

Pro Tips

Don't rotate too fast; let the trend confirm.

Use SIPs or staggered entry in new sectors.

Avoid “hot tips”; follow actual price and volume.

Blend sector rotation with strong stock selection (don’t just chase sector).

Conclusion

The Sector Rotation Strategy is one of the smartest, most practical tools used by both traders and investors. You don’t need to be a pro to use it — just stay alert to the market mood, economic cycles, and where the money is moving.

Think of it as dancing with the market:

“When the music changes, you change your steps.”

Keep rotating. Keep growing.

The 3-Method Framework: Simplifying Technical AnalysisMost traders get caught up in complex indicator setups, thinking that more tools equal better results. We rely on moving averages to tell us if prices are trending up or down, and we depend on support and resistance levels to predict market movement. But what if I told you there's a simpler, more powerful way to read the market using pure price action?

Today, I want to share my experience and understanding of bias and expectations for the next candle formation. This approach is refreshingly simple because we don't need to understand every single price movement - we just need to focus on what matters most.

Method 1: Opening Price Comparison

The first method is beautifully straightforward. For a bullish bias, the current opening price should be above the previous opening price. That's it. Sounds almost too simple, right? But simplicity often holds the greatest power in trading.

For Gold yesterday, we simply needed to compare the latest opening price on the Daily timeframe with the previous opening price. It's that simple.

Method 2: Mid-Level Analysis

The second approach involves comparing mid-levels between candles. We compare the mid-level of the previous candle with the mid-level of the candle before that. I know it might sound a bit complicated when explained this way, but once you visualize it on your chart, the concept becomes crystal clear.

Still on Gold, we just compare the 50% or mid-level of the previous candle with the candle two periods back from the latest candle on the daily chart.

Method 3: Expansion Expectations

The third method helps us anticipate expansion in price. Traditional complex methods require analyzing numerous factors, but this simplified approach only needs two candles before the current one. Here's how it works: we use the high and low of the candle two periods back, and the open and close (body) of the previous candle. If the previous candle's body sits within the high-low range of the two-candle-back formation, we can expect price expansion.

The beauty of this method is that we don't care whether the price is bullish or bearish - we simply expect expansion to occur. Think of it like a compressed spring: when price gets squeezed within a previous range, it often seeks to break out in either direction. We're not predicting the direction, just the likelihood of significant movement.

Still on Gold, I randomly selected all inside candles on the Daily timeframe. Remember, the purpose is only to expect expansion, not direction. If you want to use this for directional bias, make sure you apply the additional analysis required.

Remember, there are no guarantees in trading, but this method provides valuable insight into potential market expansion.

Advanced Combinations for Enhanced Analysis

Combining Methods 1 and 2 creates our most accessible approach since you only need two candles. When both the opening price and mid-point from two candles ago indicate bullish conditions, we can expect the current candle to follow an OLHC bullish pattern.

You can see the 3 examples I've provided in the image, and all of these are applicable across all timeframes, both daily and 4-hour.

Combining all three methods offers a more sophisticated analysis, particularly useful for anticipating market reversals. This involves marking the current and previous opening prices, comparing mid-levels from the last two candles, and identifying the high/low range from two to three candles back.

Now I'm adding Inside Candles from 2-3 periods back (My personal rule is maximum 3 candles before the current candle, or this analysis will lead to analysis paralysis).

The Bullish and Bearish Rules

Bullish Rule 1:

Opening price above the previous opening price

Mid-level of the previous candle above the mid-level of the previous candle before that.

Inside candle formation (optional)

Bearish Rule 1:

Opening price below the previous opening price

Mid-level of the previous candle below the mid-level of the previous candle before that.

Inside candle formation (optional)

The Secret Sauce: Timeframe Harmony

Here's where the "devil is in the details" comes into play. You might find perfect bullish conditions on your chart, but the market still reverses. The secret lies in using this method on Daily and 4-hour timeframes simultaneously.

Simply understand it from the chart.

Simply understand it from the chart.

If Rule 1 conditions are met on the daily chart, they must also align on the 4-hour chart. When the 4-hour contradicts the daily, follow the 4-hour signal as it might indicate a "sell on strength" or "buy on weakness" scenario.

The formula is simple: must align with

I've never tested this on 1-hour charts because the Daily and 4-hour combination provides sufficient accuracy for my trading approach.

Enhanced Rules for Precision

Rule 2 makes the inside candle formation mandatory rather than optional. Sometimes you'll encounter mixed signals where the mid-level suggests one direction while the opening price suggests another. The solution? Drop down to a lower timeframe for additional confirmation.

I don't recommend using this method below the 4-hour timeframe, but you can certainly apply it to Monthly or Weekly charts for long-term bias determination. The key is analyzing both Daily AND 4-hour timeframes together, not just one or the other.

When timeframes conflict, often just one key level provides the confirmation you need - typically a previous Monthly or Weekly high or low.

Final Thoughts

Pure price action mastery isn't about having the most sophisticated setup or the most indicators on your chart. It's about understanding the fundamental relationship between opening prices, mid-levels, and candle formations across meaningful timeframes.

This approach has served me well because it cuts through market noise and focuses on what price is actually telling us. Start with these three methods, practice identifying the patterns, and gradually build your confidence in reading pure price action.

Remember, consistent profitability comes from mastering simple, reliable methods rather than chasing complex strategies. Keep practicing, stay disciplined, and let price action guide your trading decisions.

Good Luck! :)

Shorting Isn’t the Problem. Being a Psycho Bear Is.😵💫🪓 Shorting Isn’t the Problem. Being a Psycho Bear Is. 🔻📉

Hollywood is never wrong:

The genius from The Big Short is the psycho from American Psycho .

Same actor (C. Bale) — two sides of the same trader.

🎭 I made this chart because I see this often on TradingView:

People who prefer to short. Hoping for collapse.

Even Rooting for war. To Celebrating blood short profit.

Perma-bears who hate seeing price go up because they missed the trade.

Let’s be real — that’s not trading.

That’s emotional self-destruction masked as 'strategy'.

We just saw over $1B in shorts liquidated as Bitcoin ripped through $118K.

And still — some refuse to let go of their bias.

This chart says it all:

🔹 The "Smart Bear" — does research, uses structure, trades what’s real.

🔻 The "Psycho Bear" — needs things to collapse, just to feel right.

💔 And here’s the truth I want to share with you today:

If you catch yourself unable to celebrate others making money ,

If you feel angry when price pumps and you missed it,

If you’re wishing for collapse or chaos just so you feel seen...

Something’s off. That’s not trading. That’s pain talking.

Buying is more than just a trade — it’s hope , it’s optimism , it’s love .

Being bullish is an act of belief in the future.

And yes — we sometimes need to short. We do it with clarity.

But I’m a bull who sometimes must go short. Not a bear who wants the world to burn.

“We go long. We go short. But we never go blind.”

📉 Don’t let bitterness guide your charts.

📈 Let discipline, structure — and a bit of heart — guide you instead.

One Love,

The FXPROFESSOR 💙

⚠️ Disclosure:

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

#AN019: Digital Currencies (CBDCs) Will Change Forex

How the world of official digital currencies (CBDCs) is already impacting Forex, opening up new opportunities rarely considered elsewhere. Hello, I'm Forex Trader Andrea Russo.

On the one hand, Shanghai is evaluating countermeasures against stablecoins and cryptocurrencies, including yuan-backed currencies, while China is moving closer to a reasonable transition to its own "soft" stablecoin, after years of restrictions on crypto trading. On the other, Pakistan is launching a pilot CBDC, aligning itself with a momentous shift: it is now shaping its own digital monetary system, with direct impacts on inflation, reserves, and currency pairs.

These initiatives are not isolated. They are part of a global phenomenon: over 130 central banks are studying or testing CBDCs, with Europe, China, and the Middle East at the forefront. American hostility (e.g., the ban on digital dollars) risks pushing others to consolidate their own digital currencies as a geopolitical and financial shield.

In Forex, these developments could generate repercussions even in the short term:

EUR/CNY or INR exchange rate: Retail and wholesale CBDCs will facilitate direct trade, reducing dependence on the dollar, and potentially giving rise to new flows in Asian crosses.

Reduced cross-border costs and times: Systems like mBridge (China, Hong Kong, Thailand, UAE, Saudi Arabia) will allow instant transactions and cross-border digital currencies, breaking down SWIFT's dominance and encouraging lower demand for USD payments.

New interest rate paradigm: CBDCs may include fixed interest rates, creating competitive pressure on swaps and futures, and forcing traditional central banks to clarify their strategies.

Digital Safe Havens: If EUR or CNY become globally interoperable, new forms of safe haven currencies could emerge, impacting crosses such as EUR/USD, USD/CNY, and INR/USD.

Actional conclusion for Forex traders:

We will soon enter uncharted territory: it will not just be a matter of evaluating central banks and SMEs, but also of understanding if and when official digital payment systems will have a real impact on currency routes.

For those who want to anticipate flows:

Monitor CBDC pilots in Asia and the Middle East.

Keep an eye on retail adoption in the BRICS countries: in the coming quarters, we could see direct flows from USD to digital CNY, INR, and AED.

Evaluate potential longs on digital-friendly crosses (e.g., USD/INR digital) and shorts on USD linked to interest in stablecoins.

Forex is entering its new digital era: the question is only one: are you ready to navigate it?

Not All Pin Bars Are Created EqualA Two-Step Filter to Find the Ones That Actually Matter

We’ve all seen them. Long wicks, tight bodies, price rejecting a level. The classic pin bar. Textbook stuff, right?

But here’s the problem. Pin bars show up all over the chart. Some lead to clean reversals. Most do absolutely nothing. The trick isn’t spotting them. It’s knowing which ones to trust.

This is where a simple two-step filter can help. By asking two key questions, you immediately improve the quality of your trades and cut down on the false positives.

Step One: Where Did It Happen?

Before you look at shape or size, ask yourself one thing.

Did this pin bar form at a meaningful level?

Context is everything. A pin bar that forms into thin air, mid-range or in the middle of chop might look good, but it’s rarely reliable. What you’re looking for is reaction from structure. That could mean:

• A clean horizontal support or resistance level

• A prior swing high or low

• A daily VWAP or anchored VWAP from a key event

• The edge of a range or value area

• A trendline tested multiple times

In short, the level gives the pin bar a reason to exist. It becomes a reaction, not a random candle.

Mark the level before the candle forms. This stops you from retrofitting significance where there isn’t any.

Example:

Here we can see how the volume weighted average price (VWAP) can add meaningful context to a pin-bar setup. In this case, USD/CAD retraced against the prevailing downtrend and tested the VWAP anchored to the recent swing highs. At that point, price formed a clear pin-bar reversal, signalling rejection and potential continuation with the broader trend.

USD/CAD Daily Candle Chart

Past performance is not a reliable indicator of future results

Step Two: What’s Happening Under the Hood?

Once you’ve got a pin bar at a meaningful level, it’s time to look deeper. One of the best ways to do that is by dropping down to a lower timeframe, like the 5-minute chart, and replaying the session that created the candle.

Why?

Because daily candles can hide a lot. A clean pin bar might look like a strong rejection, but on the intraday chart, it might just be a low-volume fakeout or one impulsive move during quiet hours. On the other hand, a pin bar backed by real market structure is far more likely to hold.

Here’s what to look for on the lower timeframe:

• Was there a liquidity grab or stop run into the level?

• Did price pause, base or reverse with intent?

• Were there multiple attempts to push beyond the level that failed?

• Did volume spike during the rejection?

When a pin bar reflects a genuine intraday battle, not just a random wick, it often tells you more about the intentions of real participants.

Example:

In this example, GBP/USD forms a bearish pin-bar at a key area of swing resistance on the daily chart. Dropping down to the 5-minute timeframe helps reveal what actually happened inside that candle.

On this lower timeframe we can see that price initially pushed above resistance but failed to hold, triggering a steady wave of intraday selling pressure. This move was followed by a mild pullback during the latter half of the US session and into the New York close, reinforcing the idea of rejection and offering insight into the mechanics behind the pin-bar.

GBP/USD Daily Candle Chart

Past performance is not a reliable indicator of future results

GBP/USD 5min Candle Chart: How the Daily Pin-bar Formed

Past performance is not a reliable indicator of future results

Bonus Filter: What’s the Trend Context?

You could also add a third layer if you want to refine even further. Is the pin bar counter-trend, or is it a pullback within trend?

Counter-trend pin bars at key levels can work, but they’re lower probability and often take more time to play out. Pin bars that form as part of a pullback to structure in the direction of the prevailing trend tend to move more cleanly.

This is where using something like a 20 EMA or anchored VWAP can help frame the setup.

Putting It All Together

Next time you see a pin bar, pause. Don’t rush in. Ask yourself:

• Did this happen at a level that matters?

• Does the intraday story back up the candle?

If the answer is yes to both, now you’ve got something worth trading. Not just another wick in the wind.

Pin bars can be strong signals, but only when they reflect real intent. This two-step filter helps you cut through the clutter and focus on the ones that do.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The Power of Confluence: Building Trade Setups Using 3 Indicator🔵 INTRODUCTION

Many traders fall into the trap of relying on a single indicator to make trading decisions. While one tool might work occasionally, it often leads to inconsistent results. The key to consistency lies in confluence — the strategic combination of multiple indicators that confirm each other.

In this article, you'll learn how to build high-probability trade setups by combining three essential components: trend , momentum , and volume .

🔵 WHY CONFLUENCE MATTERS

Confluence refers to multiple signals pointing in the same direction. When different indicators agree, your trade idea becomes much stronger. It helps reduce noise, avoid false signals, and increase confidence in your entries.

Think of it like crossing a busy road: you wait for the green light, check both sides, and make sure no cars are coming. The more confirmations you have, the safer your move.

🔵 WHAT IS CONFLUENCE IN TRADING?

Confluence means agreement. In trading, it’s when different methods, indicators, or tools all point toward the same outcome.

Think of it like this:

One green light? Maybe.

Two green lights? Worth watching.

Three green lights? That’s a trade worth considering.

Imagine you're planning a road trip. You check the weather forecast (trend), Google Maps traffic (momentum), and ask a local for advice (volume). If all three say “go,” you’re more confident in your decision. Trading works the same way — using multiple tools to validate a setup reduces risk and removes guesswork.

Important: Confluence is NOT about cramming 10 indicators onto your chart. It’s about using a few that each offer different types of information — and only acting when they align.

🔵 THE 3-STEP CONFLUENCE SETUP

1️⃣ Identify the Trend (Using EMAs)

Before entering any trade, you need to know the market direction. You can use:

Moving Averages (e.g., 21 EMA and 50 EMA crossover)

Structure-based analysis (e.g., higher highs = uptrend)

Trade only in the direction of the prevailing trend.

2️⃣ Check Momentum (Using RSI, MACD, or Stochastic)

Momentum tells you whether the market supports the current trend or if it's weakening.

RSI above 50 → Bullish momentum

MACD histogram rising → Acceleration

Stochastic crossing above 20 or 80 → Momentum shifts

Avoid entering when momentum is fading or diverging from price.

3️⃣ Confirm with Volume (To Validate Participation)

Volume reveals the strength behind the move. A breakout or trend continuation is more reliable when it's backed by volume.

Look for:

Volume spikes at breakout points

Increasing volume in the direction of the trend

Volume confirmation after pullbacks or retests

No volume = no conviction. Watch how the market "votes" with actual participation.

🔵 EXAMPLE TRADE SETUP

Let’s say you spot a bullish trend with 21 EMA above 50 EMA. RSI is above 50 and rising. A pullback forms, and volume picks up as price starts to push higher again.

That’s trend + momentum + volume lining up = a confluence-based opportunity.

🔵 BONUS: HOW TO ENHANCE CONFLUENCE

Add price action patterns (flags, wedges, breakouts)

Use support/resistance zones for cleaner entries

Combine with higher timeframe confirmation

Wait for retests after breakouts instead of chasing

Confluence doesn't mean complexity — it means clarity.

🔵 CONCLUSION

The best traders don’t guess. They wait for the market to align. By combining trend, momentum, and volume, you filter out weak setups and focus only on the highest-probability trades.

Start testing confluence-based setups in your strategy. You’ll likely find more consistency, fewer fakeouts, and greater confidence in your execution.

Do you trade with confluence? What’s your favorite trio of indicators? Let’s talk in the comments.

Institutional Trading Process 1. Investment Idea Generation

This is where it all begins.

Institutions generate trading ideas based on:

Fundamental research (company earnings, macroeconomic data)

Quantitative models (statistical or algorithmic strategies)

Technical analysis (price action, trends, volume)

Sentiment analysis (news flow, social media, market psychology)

Often, the research team, quant team, or portfolio managers work together to develop high-conviction trade ideas backed by data and analysis.

2. Pre-Trade Analysis and Risk Assessment

Before placing a trade, institutions perform:

Risk/reward analysis

Scenario testing (How does the trade perform in different market conditions?)

Volatility analysis

Position sizing based on portfolio risk budget

Forex Market Depth Analysis and Trading StrategiesForex Market Depth Analysis and Trading Strategies

Forex market depth analysis offers traders a deeper understanding of currency market dynamics. It reveals the real-time volume of buy and sell orders at different prices, which is crucial for assessing liquidity and trader sentiment. This article explores how to analyse and use market depth for trading, discussing various strategies and their limitations.

Forex Market Depth Explained

Market depth meaning is the volume of buy and sell orders at different price levels. It's a real-time snapshot of the pair’s liquidity and depth of supply (sell orders) and demand (buy orders). Traders use this information to gauge the strength and direction of a currency pair.

This depth is typically represented through an order book, displaying a currency pair’s existing orders at various price points. This book lists the number of units being bid or offered at each point, giving us insight into potential support and resistance levels. For instance, a large number of buy orders at a certain price level may indicate a strong support area, suggesting that many traders are willing to purchase the currency pair at this price.

Understanding market depth is crucial in assessing the likelihood of trades being executed at desired prices, especially in fast-moving currencies or when trading large volumes. It may help in identifying short-term price movements, offering a more nuanced view of an asset beyond just candlestick charts.

How to Analyse Market Depth

Analysing order flow is a fundamental aspect of market depth trading, providing traders with valuable insights into the supply and demand dynamics of forex pairs. Forex market depth can be assessed using various tools and indicators.

One key tool is the Depth of Market (DOM), which shows the number of buy and sell orders pending at different prices. DOM offers a visual representation of the currency pair’s order book, highlighting potential areas where large orders are placed. We can use such information to identify significant support and resistance levels where the pair might experience a turnaround.

Another essential tool is Level II quotes. These quotes provide detailed information about the price, volume, and direction of every trade executed in real-time. By analysing Level II quotes, traders may be able to identify the pair’s momentum and potential trend shifts. For example, if there is a sudden increase in sell orders at a particular price, it may indicate a potential downward movement, prompting us to adjust our positions accordingly.

Strategies Using Market Depth Analysis

In forex trading, market depth analysis is a crucial tool for understanding and executing a depth of market strategy. Here's how traders can leverage this type of analysis in their strategies:

Scalping Strategy

By closely observing the DOM, scalpers can identify minor price movements and liquidity gaps. For instance, if the DOM shows a large number of sell orders at a slightly higher price, a scalper might open a short position, anticipating a quick downturn. This strategy relies on fast, short-term trades, capitalising on small price changes.

Momentum Trading

Momentum traders use the order book to gauge the strength of a trend. By analysing the order flow and volume, they can determine if a trend is likely to continue or reverse. For example, a surge in buy orders at increasing prices may signal a strong upward momentum, prompting a trader to enter a long position. Conversely, a build-up of sell orders might indicate a potential downward trend.

Support and Resistance Trading

Depth analysis is invaluable for identifying key support and resistance levels. Clusters of orders often act as barriers, influencing price movements. Traders may use these levels to set entry and exit points. For example, a large number of buy orders at a specific price may indicate a strong support zone, reflecting a potentially good entry point for a long position.

Breakout Trading

Traders seeking breakout opportunities can use market depth to spot potential breakout points. A significant accumulation of orders just beyond a known resistance or support level may indicate a potential breakout. If the pair moves past these areas with high volume, it could signal the start of a new trend, potentially offering a lucrative trading opportunity.

Integrating Market Depth with Technical Analysis

Integrating a depth chart trading strategy with technical analysis may enhance decision-making, combining the real-time insights of depth charts with the power of technical indicators. For instance, we can use market depth to confirm signals from technical analysis tools.

If a moving average crossover suggests a bullish trend, a corresponding increase in buy orders in the depth chart may reinforce the signal. Similarly, a significant resistance level identified through technical analysis, such as a Fibonacci retracement level, might be substantiated if there’s a large accumulation of sell orders at that price point.

Risks and Limitations of Market Depth Analysis

While market depth analysis is a valuable tool in forex trading, it comes with certain risks and limitations:

- Dynamic and Fast-Changing Data: Order book data is highly dynamic, often changing within seconds, making it challenging to base long-term strategies solely on such information.

- Lack of Centralisation in Forex: Unlike stock exchanges, the forex market lacks a centralised exchange. This decentralisation means depth data might not represent the entire marketplace accurately.

- Susceptibility to 'Spoofing': Large players might place and quickly withdraw large orders to manipulate market depth perception, misleading other traders. It’s worth noting that spoofing is illegal in many jurisdictions.

- Limited Usefulness in Highly Liquid Markets: In highly liquid pairs, the depth of market data may become less relevant, as large orders are quickly absorbed without significantly impacting prices.

- Dependency on Broker's Data: The reliability of order book data depends on the broker's technology and the size of their client base, which can vary widely.

The Bottom Line

Market depth analysis provides critical insights for forex traders, though it's vital to recognise its dynamic nature and limitations. Integrating it with technical analysis may create robust trading strategies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Price action is the vehicle—but these charts show the road aheadIn the world of trading, technical analysis often gets the spotlight—candlesticks, moving averages, and indicators. But beneath every price movement lies a deeper current: macroeconomic forces. These forces shape the environment in which all trades happen.

Great traders don’t just react to price—they understand the context behind it. That context is found in macro charts: the financial “weather maps” of markets. These charts reveal whether capital is flowing toward risk or safety, whether inflation is heating up or cooling down, and whether liquidity is expanding or shrinking.

In this post, we’ll explore 10 macro charts that can elevate your edge, backed by proven examples of how they’ve helped traders stay on the right side of the market. These aren't just charts—they’re market truths in visual form.

1️⃣ DXY – U.S. Dollar Index

Why it matters:

The U.S. dollar affects everything: commodities, stocks, global trade, and especially forex. The DXY measures its strength against major currencies.

📉 Chart Reference:

In 2022, DXY surged past 110 due to aggressive Fed rate hikes. This crushed EURUSD, pressured gold, and triggered a global risk-off move. Traders who tracked DXY rode USD strength across the board.

💡 Use it to: Confirm trends in FX and commodities. Strong DXY = bearish pressure on gold and risk assets.

2️⃣ US10Y – 10-Year Treasury Yield

Why it matters:

This is the benchmark for interest rates and inflation expectations. It guides borrowing costs, equity valuations, and safe-haven flows.

📉 Chart Reference:

In 2023, the 10Y spiked from 3.5% to nearly 5%, leading to weakness in growth stocks and boosting USD/JPY. Bond traders saw it first—equities followed.

💡 Use it to: Anticipate moves in growth vs. value stocks, and confirm macro themes like inflation or deflation.

3️⃣ Fed Dot Plot

Why it matters:

This is the Fed’s forward guidance in visual form. Each dot shows where a policymaker expects interest rates to be in the future.

📉 Chart Reference:

In Dec 2021, the dot plot signaled a faster pace of hikes than the market expected. Those who caught the shift front-ran the USD rally and equity correction in early 2022.

💡 Use it to: Predict future rate policy and align your macro bias with the Fed's path.

4️⃣ M2 Money Supply (US)

Why it matters:

This chart tracks the amount of money in the system. More liquidity = fuel for risk. Less = tightening conditions.

📉 Chart Reference:

After COVID hit, M2 exploded, leading to a major bull run in stocks and crypto. When M2 began contracting in 2022, asset prices peaked and reversed.

💡 Use it to: Gauge macro liquidity conditions. Expansion is bullish; contraction is dangerous.

5️⃣ Copper/Gold Ratio

Why it matters:

Copper is a growth metal; gold is a fear hedge. Their ratio acts as a risk-on/risk-off indicator.

📉 Chart Reference:

In 2021, the copper/gold ratio surged—signaling growth and optimism. This preceded strong gains in cyclical equities and commodity currencies like AUD and CAD.

💡 Use it to: Confirm risk sentiment and lead equity or FX trends.

6️⃣ VIX – Volatility Index

Why it matters:

VIX tracks expected volatility in the S&P 500. It's often called the "fear index."

📉Chart Reference :

In March 2020, VIX spiked to nearly 90 as COVID panic set in. This extreme fear was followed by one of the greatest buying opportunities of the decade.

💡 Use it to: Time entries and exits. High VIX = fear = possible reversal. Low VIX = complacency = caution.

7️⃣ Real Yields (10Y TIPS - CPI)

Why it matters:

Shows the inflation-adjusted return on bonds. Real yields affect gold, tech, and risk appetite.

📉Chart Reference :

In 2022, real yields went from deeply negative to positive—crushing gold and high-growth stocks.

💡 Use it to: Confirm direction in gold, NASDAQ, and broad macro trends.

8️⃣ Oil Prices (WTI or Brent)

Why it matters:

Oil is both a growth and inflation input. Rising prices mean higher costs and often precede policy tightening.

📉Chart Reference :

Oil’s rally in early 2022 foreshadowed CPI spikes and led central banks to turn hawkish. Traders who tracked it saw inflation risks building early.

💡 Use it to: Forecast inflation, assess energy-related equities, and understand global demand.

9️⃣ Global PMIs (Purchasing Managers’ Indexes)

Why it matters:

Leading indicator of economic health. PMIs above 50 = expansion. Below 50 = contraction.

📉 Chart Reference:

In 2023, China’s PMI consistently printed below 50—signaling manufacturing weakness and global demand concerns. This helped traders avoid overexposure to emerging markets.

💡 Use it to: Gauge growth momentum globally and regionally.

🔟 SPX vs. Equal-Weighted SPX (Breadth Divergence)

Why it matters:

Shows whether the S&P 500 rally is broad-based or just driven by a few megacaps.

📉Chart Reference :

In early 2024, the index made new highs—but the equal-weighted version lagged badly. That divergence warned traders of a fragile rally.

💡 Use it to: Detect weakness beneath the surface and avoid false confidence in rallies.

🧠 Nerdy Tip: Macro Is the Invisible Hand

These charts don’t give you trade entries—but they give you conviction, timing, and perspective.

When you combine macro context with technical setups, you trade in sync with the market’s deeper rhythm.

So before you place your next trade, ask yourself:

What are yields doing?

Is liquidity expanding or drying up?

Is risk appetite rising or falling?

put together by : @currencynerd as Pako Phutietsile

Mastering the Bollinger Bands- How to use it in trading?What is the Bollinger Bands

Bollinger Bands is a popular technical analysis tool developed by John Bollinger in the 1980s. It is designed to measure market volatility and provide signals for potential price reversals or trend continuations. The Bollinger Bands consist of three lines: a simple moving average in the middle, usually calculated over 20 periods, and two outer bands that are placed a set number of standard deviations above and below the moving average. These outer bands automatically adjust to market conditions, expanding and contracting based on price volatility. The indicator is widely used by traders to understand the relative highs and lows of a financial instrument in relation to recent price action.

What will be discussed?

- How does it work with the lower band and upper band?

- What does the narrowing mean?

- What does the widening mean?

- How to trade with the Bollingers Bands?

-------------------------

How does it work with the lower band and upper band?

The upper band and the lower band serve as dynamic levels of resistance and support. When the price of an asset touches or exceeds the upper band, it may be considered overbought, suggesting that a reversal or pullback could be near. Conversely, when the price approaches or breaks below the lower band, the asset may be viewed as oversold, indicating a potential rebound. These bands do not generate definitive buy or sell signals on their own but instead help traders assess market conditions. The interaction of price with the upper and lower bands often provides visual cues about the momentum and direction of the market, allowing for more informed decision-making.

-------------------------

What does the narrowing mean?

The narrowing of the Bollinger Bands occurs when the price becomes less volatile over time. This contraction indicates a period of consolidation or low market activity, where the price is trading in a tighter range. Narrowing bands are often interpreted as a signal that a significant price movement may be coming soon, as low volatility tends to precede high volatility. This phase is sometimes referred to as the "squeeze," and traders closely monitor it to anticipate breakout opportunities. The direction of the breakout, whether upward or downward, is not predicted by the narrowing itself but usually follows shortly after the bands have contracted.

-------------------------

What does the widening mean?

The widening of the Bollinger Bands reflects increasing market volatility. When the price starts to move rapidly either up or down, the bands spread further apart to accommodate this movement. This expansion typically confirms that a new trend is underway or that a breakout has occurred. The wider the bands become, the greater the degree of price fluctuation. During these times, traders may observe stronger momentum in the market, and the continuation of the move may be supported by the growing distance between the bands. However, extremely wide bands may also suggest that a reversal could be nearing, as the market can become overstretched in either direction.

-------------------------

How to trade with the Bollinger Bands?

Trading with Bollinger Bands involves using the bands to identify entry and exit points based on the behavior of price in relation to the upper and lower bands. One common approach is to buy when the price touches or breaks below the lower band and shows signs of bouncing back, and to sell when the price reaches or moves above the upper band and begins to retreat. Another strategy involves waiting for the bands to narrow significantly and then entering a trade in the direction of the breakout that follows. Traders often use Bollinger Bands in combination with other indicators such as RSI, MACD, or volume to confirm signals and reduce the risk of false breakouts. It is important to remember that Bollinger Bands are not predictive on their own but are most effective when used as part of a broader technical analysis framework.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

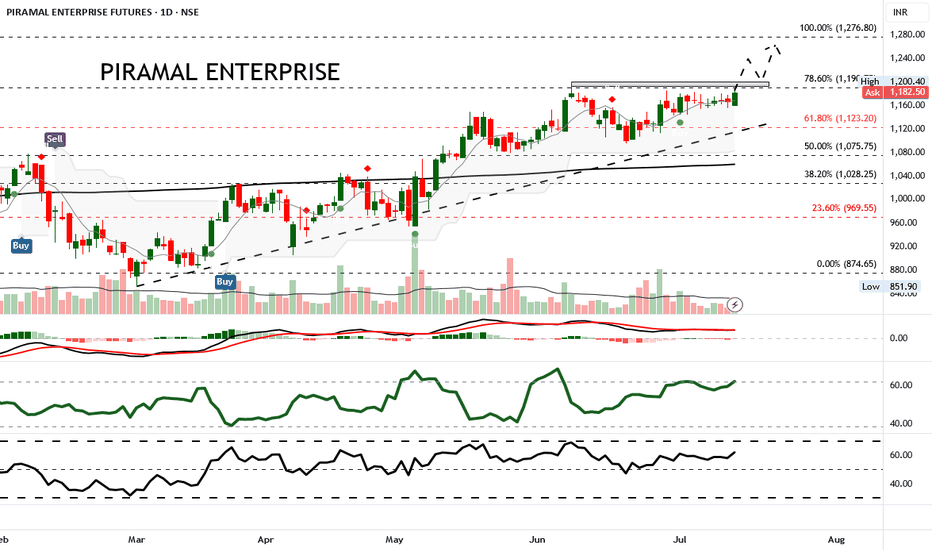

Ascending triangle signals breakout potential above ₹1,185.Piramal Enterprise Futures has shown steady upward momentum recently, gaining 1.60% in the latest session to close at ₹1,184.90. The price continues to trade within an ascending channel, nearing a key resistance zone. Price action is consolidating beneath the 78.6% Fibonacci retracement level at ₹1,191, with low volatility as indicated by tight candle spreads and moderate ATR levels.

Trade Recommendation: Buy above ₹1,185 with Target ₹1,250 and Stop-Loss at ₹1,140.

This trade setup is based on the bullish triangle formation and positive momentum indicators. Entry is placed just above resistance to catch a breakout, while the target aligns with the 100% Fibonacci extension at ₹1,276 but is capped at ₹1,250 for a conservative approach.

#AN018: Summer shock, tariffs, Fed delays, and the dollar's shif

In recent days, the forex world has experienced a sequence of key events that could redefine the global currency landscape in the coming months. Risk to the dollar has become structural, the threat of tariffs is multiplying again, and the combination of geopolitical uncertainty and monetary policy creates an extremely risky mix for exchange rates.

Let's start with the Fed minutes: Jerome Powell attributed tariff risk to the main reason for postponing possible rate cuts. Market expectations are realigning toward a longer rate cycle, fueling a climate of global uncertainty. At the same time, Goldman Sachs warns that the dollar is increasingly moving as a "risky" currency, correlated with equity markets—an emerging market rather than a safe haven.

On the geopolitical front, President Trump has relaunched the trade war: announcements of tariffs of up to 35% on Canada, up to 20% on Europe, and 50% on copper from Brazil have caused futures volatility to soar and sent the dollar into a short-term rally. But Deutsche Bank is sounding the alarm: the summer period of low liquidity and rising trade tensions represents a potential trigger for prolonged currency turbulence.

The Financial Times envisions a scenario in which the dollar loses ground as the dominant currency, ushering in a multipolar currency world in which the euro, renminbi, gold, and even cryptocurrencies could gain ground.

The impact on Forex:

USD: The narrative is changing: no longer a net safe haven, but an asset correlated with political and risk cycles. The weakness of the DXY index in the first half of 2025 (-10%) reflects this transition.

EUR/USD: Potentially favored if the dollar continues its consolidation. However, new tariffs and US-EU uncertainty could provide temporary support for the greenback.

USD/JPY and USD/CHF: These crosses will be subject to greater volatility, with the next catalyst being the Fed minutes and the timing of tariffs. Safe-haven currencies strengthen during periods of uncertainty.

CAD, AUD, NZD: penalized by tariffs on Canada and Brazil and a weak dollar. OPEC+ and geopolitical tensions could boost commodities, but data confirmation is needed.

Commodity cross-correlation: USD/CAD could rebound if oil loses momentum, while AUD/JPY is sensitive to both the RBA and increased global risk.

Conclusion:

The current currency environment appears unstable and sensitive to political and trade developments. Summer volatility could persist, and those who can read the macro and institutional signals (Fed, tariffs, geopolitics) will have the opportunity to enter accurately. Until a stable direction emerges, EUR/USD looks like the most interesting cross to capture a potential structural correction in the dollar.

AMP Futures - How to export data from your Trading PanelIn this idea, we will demonstrate how to export data from your Trading Panel using the TradingView platform.

Unfortunately, the recording did not show the demonstration of the exported CSV files; however, as long as you follow the steps provided, you will be able to export the proper data.

Understanding Elliott Wave Theory with BTC/USDIntroduction to Elliott Wave Theory:

Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology.

At the core of Elliott’s theory is the idea that markets move in a 5-wave pattern in the direction of the trend, followed by a 3-wave corrective pattern. These waves can be seen on all timeframes and help traders identify potential entry and exit points in the market.

Key Concepts of Elliott Wave Theory:

1. Impulse Waves (The Trend)

2. These are the waves that move in the direction of the overall trend. They are labeled 1, 2, 3, 4, 5 and represent the price movement in the main direction of the market.

* Wave 1: The initial move up (or down in a bearish market). I like to mark up the first wave how I do my Fibs, from the point where price showed a major impulse.

* Wave 2: A correction of Wave 1 (it doesn’t go lower than the starting point of Wave 1).

* Wave 3: The longest and most powerful wave in the trend.

* Wave 4: A smaller correction in the direction of the trend.

* Wave 5: The final push in the direction of the trend, which can be shorter and weaker than Wave 3.

3. Corrective Waves (The Pullbacks)

4. After the five-wave impulse, the market enters a corrective phase, moving against the trend. This corrective phase is generally a 3-wave pattern, labeled A, B, C:

* Wave A: The initial correction, typically smaller than Wave 3.

* Wave B: A temporary move against the correction (it often confuses traders who think the trend has resumed).

* Wave C: The final move against the trend, usually the strongest and most aggressive.

How to Implement Elliott Wave on BTC/USD:

Let’s break down how you can apply the Elliott Wave Theory to BTC/USD using a simple example.

1. Identify the Trend

2. Start by identifying the current market trend for BTC/USD. Are we in an uptrend or downtrend? This will determine whether you’re looking for a 5-wave impulse up (bullish) or down (bearish).

3. Locate the Waves

4. Look for the five-wave structure in the trend direction. Once you identify a potential impulse move, label the waves accordingly:

* Wave 1: A new uptrend starts.

* Wave 2: A small pullback (usually less than the size of Wave 1).

* Wave 3: A significant surge in price, often the most volatile.

* Wave 4: A smaller pullback or consolidation.

* Wave 5: The final push higher, which might show signs of exhaustion.

5. Corrective Phase

6. After completing the 5-wave impulse, expect a corrective 3-wave pattern (A, B, C). These corrections typically last longer than expected and can often confuse traders.

* Wave A: Price starts to reverse.

* Wave B: A retracement that may confuse traders into thinking the trend is resuming.

* Wave C: A strong pullback that brings the price even lower.

7. Use Fibonacci Levels as confluence

8. One of the most powerful tools in Elliott Wave analysis is Fibonacci retracement levels. You can use these to predict potential levels where Wave 2 and Wave 4 could end, or where Wave C might complete the correction. Common retracement levels are 38.2%-50% for Wave 4, and 50-61.8% For Waves 2 and B but keep in mind, these wave can retrace up to 100% before the wave analysis becomes invalid. But ideally these points are where you look to make an entry.

Wave 2 Example:

This one hit the golden spot (0.5-0.618) perfectly and continued to push upward.

Wave B and C Example:

This example hit closer to the 0.786 level which is also a key level for retracement.

Wave 4 Example:

This one hit the golden spot (0.382-0.5) for Wave 4 perfectly before continue the bullish momentum.

I try to use the RED levels below (1.1 and 1.2) as my invalidation (Stop Loss) levels and the GREEN levels (-0.27 and -0.618) as my Take Profit levels. Depending on your goals you can also use Fib Levels 0.236 and 0 as partial Take Profit levels.

9. Confirm with Indicators

10. To validate your Elliott Wave counts, use other indicators like the RSI (Relative Strength Index), MACD, or Moving Averages. For example, a Wave 3 might occur when the RSI is above 50, indicating strength in the trend.

In this example you can see the RSI cross the 50 threshold and the 3rd Wave form.

Continuation after the Wave is complete:

Tips for Trading with Elliott Wave Theory:

* Stay Flexible: Elliott Wave Theory is not set in stone. If the market doesn’t follow the expected pattern, adjust your wave counts accordingly.

* Don’t Rely on One Timeframe: A 5-wave structure on one timeframe may be part of a larger wave pattern on a higher timeframe. Always analyze multiple timeframes.

* Wave Personality: Waves don’t always look the same as stated earlier. Wave 2 can retrace up to 100% of Wave 1 and Wave 4 should generally not overlap Wave 1 or this may invalidate the Wave structure.

* Risk Management: Always use proper risk management techniques. No theory is perfect, so make sure you have a stop-loss in place to manage your risk.

Conclusion: Using Elliott Wave Theory on BTC/USD:

The Elliott Wave Theory can be a powerful tool for analyzing and forecasting price movements. By identifying the 5-wave impulse and 3-wave corrective patterns, you can gain insights into potential market direction. Just remember to use it alongside other tools and indicators for confirmation, and don’t forget to manage your risk.

As you apply it to BTC/USD or any other asset, remember that the market doesn’t always follow the "ideal" patterns, and flexibility is key. Practice on different timeframes, refine your skills, and use the theory as a part of your overall trading strategy.

Final Thoughts:

If you're just starting, don't get discouraged if you miss a wave or two. Trading is a journey, and with patience and practice, you'll begin to spot these patterns more naturally. Whether you’re analyzing Bitcoin's price action or any other asset, Elliott Wave Theory can give you a deeper understanding of market psychology.

Good Luck and Happy Trading!